[vol.013] the Million Dollar Baby Plan: The Lifetime Financial Strategy for Children

Learn how the Million Dollar Baby Plan uses participating whole life insurance to build long-term, tax-advantaged wealth for your child. From early savings to legacy planning, this strategy offers stability, growth, and lifelong protection.

As a parent or grandparent, you want to give your child every advantage — and that includes financial security. The Million Dollar Baby Plan is a smart, long-term strategy that allows you to start building wealth for your child from as early as 14 days old, using a participating whole life insurance policy that provides tax-advantaged growth, access to professionally managed par funds, and lifelong protection.

Through this policy, the owner benefits from par funds, which are investment funds managed by the insurance company. These funds generate annual dividends that help grow both the cash value and the death benefit of the policy over time, creating a stable foundation of wealth for your child’s future.

Originally created as a legacy tool, today's forward-thinking families are using this strategy to grow capital steadily and safely—without the risks or fees that come with traditional investments. It's not just about saving money—it's about planting a financial seed that grows with your child through every life stage.

This blog outlines how the plan works, its financial benefits, and why it's a valuable addition to your family's wealth strategy.

What Is the Million Dollar Baby Plan?

The Million Dollar Baby Plan utilizes Cash Value life insurance initiated shortly after a child's birth. Unlike traditional insurance products focused on protection, this plan emphasizes:

Tax-advantaged asset growth

Proven dividend history dating back to 1867

Flexible capital access

Multi-generational wealth transfer

By securing coverage at the earliest age possible, families lock in lower insurance costs while maximizing compound growth potential over decades. The result is a flexible financial asset that can fund education, homeownership, business ventures, retirement, and more.

How the Plan Supports Every Life Stage

See how the Million Dollar Baby Plan can provide specific financial support tailored to every stage of your child's life:

Childhood (0–18): Cash value accumulates tax-deferred

Age 18–25: Education expenses, travel, entrepreneurship

Age 25–45: Home down payment, business investment, emergency fund

Age 45–65: Supplemental retirement savings

Age 65–85: Structured withdrawals for income support

Legacy: Tax-free death benefit to beneficiaries

Key Financial Benefits

1. Low-Cost Structure

Fees within par funds are federally regulated and typically sit around 0.1% — substantially lower than most traditional investment options. Over decades, this fee efficiency can significantly boost your savings growth.

2. Stable, Predictable Growth

Market-based investments can offer growth, but they also come with risk and uncertainty. Participating whole life insurance provides guaranteed cash value growth that’s unaffected by market fluctuations — offering a sense of stability and control over your financial future.

3. Significant Tax Benefits

Cash value grows tax-deferred.

You can access funds tax-free.

Death benefit is paid out tax-free to your beneficiaries.

4. Easy and Protected Wealth Transfer

Ownership of the policy can be transferred to your child or grandchild without triggering any tax — creating a ripple effect of financial security that can span generations.

Complementary to Education Savings Plans

This plan is not meant to replace the Registered Education Savings Plan (RESP) but to supplement it by offering:

Broader use beyond education

Flexible contribution levels

Protection from market risk

Consistent, long-term growth—even if your child doesn’t attend post-secondary school

A Foundation That Grows with Your Child

The Million Dollar Baby Plan isn’t just about numbers—it’s about creating lifelong opportunities. With guaranteed growth, tax advantages, and flexible access to funds, this plan offers peace of mind and a lasting legacy for your family.

Whether you’re planning for education, a first home, or a secure retirement, we’re here to help you build a financial foundation that grows as your child grows.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[vol.012] RESP Canada: The Smartest Way to Save for Your Child’s Education

Explore how Registered Education Savings Plans (RESPs) can help Canadian families save for their children's post-secondary education. Learn about government grants, tax benefits, and effective strategies to maximize your education savings.

Every parent wants to provide their child with the best opportunities in life, and post-secondary education is a critical component of future success. With education costs consistently outpacing inflation, strategic planning has become not just beneficial, but essential.

The Registered Education Savings Plan (RESP) offers Canadian families a powerful solution that combines tax advantages with substantial federal and provincial grants—creating one of the most effective education funding tools in modern financial planning.

What Is an RESP?

An RESP is a tax-advantaged investment vehicle specifically designed by the Canadian government to help families save for a child's post-secondary education. The structure is simple but powerful:

You contribute funds to the RESP account.

The government adds grants to supplement your contributions.

Investments grow tax-free until the child is ready for school.

When funds are withdrawn for educational purposes, they're taxed at the student's rate (typically minimal).

Key Features of RESP

1. Government Grants

1-1. Canada Education Savings Grant (CESG)

20% matching on contributions up to $500 annually

Lifetime maximum of $7,200 per child

Additional CESG available for lower and middle-income families

1-2. Canada Learning Bond (CLB)

Provides up to $2,000 for lower-income families

Initial $500 deposit followed by $100 annually until age 15

No personal contributions required to receive this benefit

1-3. B.C. Training and Education Savings Grant (BCTESG)

$1,200 one-time grant for children born in 2006 or later

Must apply between the child's 6th and 9th birthdays

Both the child and parent must be B.C. residents

2. Tax Advantages

Tax-sheltered growth throughout the investment period

Withdrawals taxed at the student's income level (typically lower tax bracket)

Strategic withdrawals can further minimize tax implications

3. Contribution Limits

$50,000 lifetime contribution limit per beneficiary

Over-contributions subject to a 1% monthly penalty until removed

No annual contribution limit

Important Considerations

While RESPs are powerful, understanding their limitations is crucial:

Grant Repayment: Unused government grants must be returned if the beneficiary doesn’t pursue post-secondary education.

Time Constraints: RESP accounts can remain open for up to 36 years.

Educational Institution Requirements: Funds must be used at government-approved institutions to qualify for tax and grant benefits.

Contribution Penalties: Contributions exceeding the $50,000 limit incur a 1% monthly penalty on the excess amount.

Accumulated Income Payments (AIPs): If the beneficiary doesn’t attend post-secondary and the plan has been open for 10+ years (with the beneficiary aged 21+), income earned in the plan can be withdrawn as an Accumulated Income Payment (AIP), taxed as personal income with a 20% penalty—unless transferred to an RRSP within limits (up to $50,000).

Limited Fund Control: While the subscriber owns the RESP, only the beneficiary can receive Educational Assistance Payments (EAPs), limiting control over fund usage.

Effective RESP Strategies

1. Start Early

Even modest contributions benefit significantly from long-term compound growth. Beginning when your child is young maximizes the power of tax-free compounding.

2. Optimize Government Grants

Contribute at least $2,500 annually to receive the full $500 CESG. If you've missed previous years' contributions, you can catch up by contributing up to $5,000 in a single year to receive up to $1,000 in CESG.

3. Consider Family Plans

For multiple children, family RESPs allow sharing of contributions and grants among beneficiaries, offering greater flexibility.

4. Claim All Available Grants

These grants are often underclaimed — ensure you apply even if you’re not contributing regularly.

CLB: Up to $2,000 for low-income families—no contributions require

BCTESG: $1,200 for eligible B.C. children aged 6–9.

5. Align Investments with Time Horizon

As the child nears post-secondary, adjust your RESP portfolio:

Early Years: Focus on growth-oriented investments (e.g., equities)

Later Years: Gradually shift to more conservative options as education start date approaches (e.g., GICs, bonds)

6. Withdraw Strategically

Spread withdrawals across multiple academic years to optimize tax efficiency.

Educational Assistance Payments (EAPs) are taxable to the student

Personal contributions can be withdrawn tax-free

What If Your Child Doesn’t Attend?

If your original beneficiary doesn't pursue post-secondary education, you can:

Change the beneficiary (to a sibling).

Transfer up to $50,000 in earnings to an RRSP (if eligible).

Keep the plan open for up to 36 years.

Education Savings Made Simple

Saving for your child’s education doesn’t need to be complex or costly. With small, consistent contributions and a thoughtful plan, you can build meaningful educational funding over time—especially when combined with the substantial support available through Canadian government grants.

Whether you're laying the foundation or revisiting an existing RESP, gaining clarity from a trusted financial advisor can provide valuable perspective—helping you make the most of every opportunity while avoiding common pitfalls.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[vol.011] Maximize Business Success with a Strategic Group Benefits Plan

Boost productivity and employee satisfaction with a strategic group benefits plan. Reduce turnover costs, absenteeism, and improve talent retention while enhancing workplace efficiency.

As a business owner, every decision you make must ultimately strengthen your company's financial performance and competitive position. While group benefits might seem like an additional expense, they are, in reality, a strategic investment.

A well-structured group benefits plan creates tangible financial advantages through tax-efficient compensation and reduced turnover costs, while simultaneously enhancing your competitive edge and fostering a productive, engaged workforce.

The Hidden Costs of Operating Without Benefits

When business owners avoid implementing benefits programs, they often face significant hidden costs that directly impact their bottom line. High turnover rates cost between 50-200% of annual salary per replacement. Increased absenteeism averages 5-9 days per employee annually. Diminished productivity from financially stressed workers silently erodes profitability. These costs accumulate year after year, creating an invisible drain on your business resources.

How Group Benefits Transform Business Performance

When implemented strategically, group benefits convert these hidden costs into competitive advantages that strengthen both your financial position and operational capabilities:

Financial Returns That Impact Your Bottom Line

Your business experiences measurable financial benefits after implementing a strategic benefits plan:

Tax-Advantaged Compensation: Premium contributions toward group insurance are tax-deductible business expenses, effectively lowering your company's taxable income.

Reduced Recruitment Costs: Companies with comprehensive benefits attract qualified candidates more quickly and efficiently, reducing expensive recruitment processes.

Decreased Training Expenses: Improved retention rates mean fewer resources spent on training new employees, allowing you to retain institutional knowledge.

Lower Absenteeism Costs: Businesses with proper health coverage report 29% fewer sick days, translating to approximately $800 in annual productivity savings per employee.

Enhanced Business Operations Beyond Financial Metrics

While the financial benefits are compelling, the operational improvements create equally significant value:

Increased Productivity: Employees free from financial and healthcare worries demonstrate improved focus and engagement in their work.

Improved Workforce Stability: Consistent staffing leads to better customer service, product quality, and team cohesion.

Enhanced Employer Brand: Your reputation as an employer of choice strengthens your position in the marketplace and industry.

Reduced Disability Durations: Proper support systems help employees return to work more quickly after illness or injury.

Building Sustainable Competitive Advantage

These financial and operational improvements together create lasting competitive advantages:

Superior Talent Acquisition: As labour markets tighten, your comprehensive benefits package becomes a powerful recruitment tool.

Employee Loyalty: Financial security through benefits fosters deeper commitment to your company's mission and success.

Business Continuity: Reduced disruption from staff turnover or health issues maintains operational momentum.

Strategic Growth: Resources previously spent addressing turnover and absenteeism can be redirected toward expansion opportunities.

Strategic Design: Balancing Coverage and Cost

The impact of your benefits program depends entirely on strategic design that balances comprehensive coverage with financial efficiency:

Addressing Your Specific Business Vulnerabilities

Every business has unique operational and financial vulnerabilities that benefits can mitigate:

Service Businesses: Consistent staffing is critical, making disability coverage and health benefits that reduce absenteeism particularly valuable.

Knowledge-Based Companies: Retention is paramount, requiring strong retirement programs and wellness initiatives that foster long-term commitment.

Manufacturing Operations: Effective return-to-work programs and paramedical services reduce productivity losses from workplace injuries.

Sales Organizations: Performance-based benefit structures align with sales culture while providing health supports that maintain energy and focus.

Cost-Efficient Protection Components

The most financially sound programs balance day-to-day coverage with protection against major disruptions:

Healthcare Cost Containment: Strategic plan design with appropriate deductibles and drug formularies provides comprehensive coverage while controlling premium costs.

Income Protection: Disability and critical illness coverage provide a financial safety net for employees when they're unable to work due to illness or injury. This also protects your business from productivity loss, prolonged absences, and the costs of replacement staffing.

Capital Preservation: Life insurance benefits help retain key employees with significant family responsibilities without requiring excessive cash compensation.

Tax-Optimized Retirement: Group retirement solutions with employer matching create tax-efficient wealth accumulation for both your business and employees.

How we Support Your Business

At DIEM Financial Planning, we specialize in designing and managing cost-effective group benefits solutions tailored to your business needs.

Tailored Benefit Strategies

We analyze your business structure and workforce demographics to create a customized benefits plan that aligns with your financial and employee retention goals.Educational Support and Financial Workshops

We offer ongoing educational resources designed to enhance employees' financial understanding, ensuring they fully benefit from your provided group plan.Strategic Financial Advice

Our team helps you navigate complex decisions around group insurance planning, including selecting cost-effective plan selection, and sustainability strategies.Implementation and Ongoing Support

From plan setup to continuous administration, we ensure a seamless process that maximizes efficiency and long-term success.

A strategically designed group benefits plan transforms an expense into a powerful business asset that drives profitability, operational excellence, and competitive advantage. Contact us today for a comprehensive assessment that quantifies how the right benefits program will strengthen your company's financial performance and operational capabilities.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[vol.010] Smart Tax Strategies for Small Business Owners in BC

Learn smart tax strategies for small business owners in BC. Discover how to structure finances, manage passive income, and use corporate tax tools to reduce liabilities and maximize savings.

Structuring corporate finances efficiently is pivotal to long-term success. A key element of this financial optimization involves the management of corporate earnings, which presents a dual aspect: while retaining earnings within a corporation offers significant tax advantages, these same accumulated funds, when classified as passive income exceeding certain thresholds, can trigger substantially higher tax rates that ultimately diminish overall profitability.

By understanding passive income taxation and adopting strategic financial planning approaches tailored to these realities, business owners can maximize their after-tax income, safeguard hard-earned assets, and ensure long-term financial stability in an ever-changing tax environment.

Why Retain Earnings in a Corporation?

Incorporating as a Canadian-Controlled Private Corporation (CCPC) grants access to the Small Business Deduction (SBD), reducing the tax rate on the first $500,000 of active business income (ABI).

Small Business Tax Advantage in BC (2025 Rates):

Active Business Income (up to $500,000): 11% tax rate

General Corporate Rate (if SBD is lost): 27% tax rate

This preferential tax treatment enables business owners to reinvest earnings within the corporation, rather than withdrawing profits and paying up to 53.5% in personal tax.

However, accumulating too much passive income can shrink or eliminate the SBD, leading to significantly higher corporate taxes.

Understanding Passive Income Taxation

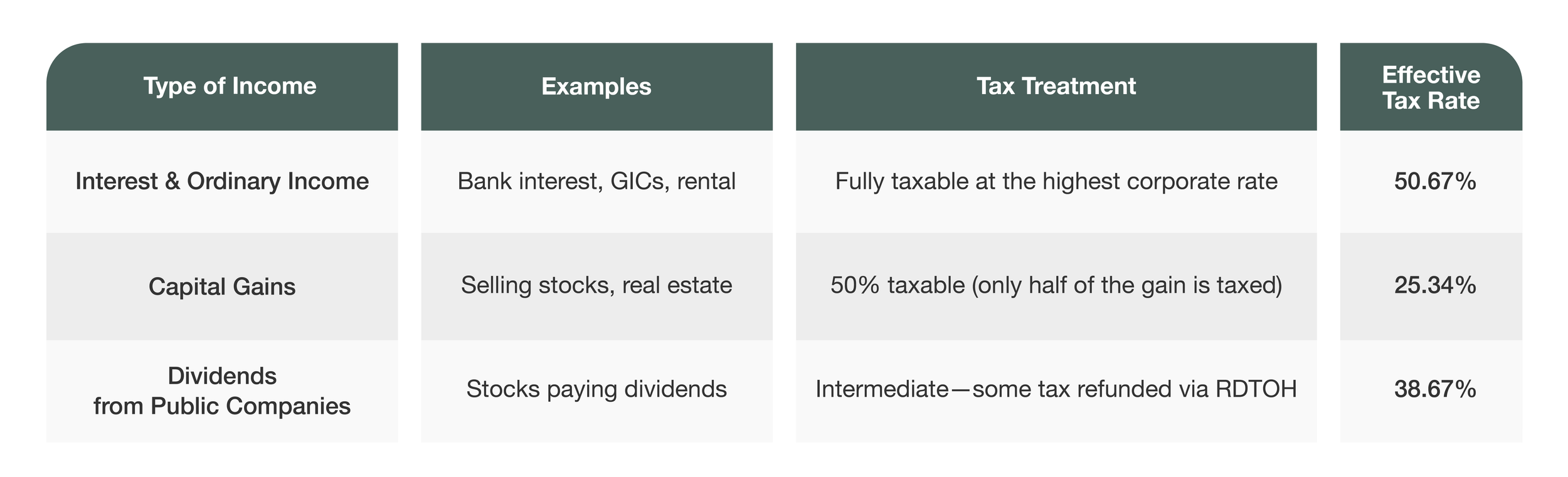

When a corporation earns investment income (passive income), it is taxed differently than active business income. Some income types are taxed at much higher rates, while others benefit from preferential tax treatment.

Among them, interest and rental income face the highest tax burden (50.67%), making them the least efficient corporate investments. Choosing lower-taxed investments like capital gains can help minimize corporate tax burdens.

Tax Treatment of Passive Income in BC (2025 Rates):

How Passive Income Can Double Your Corporate Tax Rate

Since 2019, businesses accumulating over $50,000 in passive income face a steep tax penalty, often overlooked by corporations building investment portfolios. This rule can unexpectedly increase tax rates from 11% to 27%, resulting in a substantial tax burden.

How the SBD Reduction Works:

Below $50,000 → No impact (SBD fully available).

Above $50,000 → SBD starts shrinking ($5 reduction for every $1 over the limit).

At $150,000+ → SBD is fully eliminated (corporate tax rate jumps from 11% to 27%).

Real-World Example:

A BC corporation with $600,000 in active income and $100,000 in passive income.

Passive income exceeds threshold by $50,000

SBD reduction: $50,000 × 5 = $250,000

Only $250,000 of active income(ABI) qualifies for the 11% rate ($27,500 tax)

Remaining $350,000($600,000-$250,000) taxed at 27%, instead of 11% ($94,500 tax)

Passive income of $100,000 is taxed at an assumed investment income rate of ~50% ($50,000 tax)

Total tax: $172,000

However, with proper planning to keep passive income below the $50,000 threshold, this business would have paid only $107,000 in tax. This passive income penalty results in $65,000 of unnecessary tax.

Strategic tax planning isn't optional – it's essential for protecting your hard-earned business profits.

Tax-Efficient Strategies to Reduce Passive Income Tax

1. Prioritize Capital Gains Over Interest Income

Invest in assets that appreciate over time rather than those that generate heavily taxed interest income.

2. Leverage Corporate-Owned Life Insurance

This powerful strategy goes beyond just reducing taxes—it can eliminate them:

Preserves Your Small Business Deduction – Growth accumulates tax-free without generating passive income that would trigger SBD clawbacks

Creates Tax-Free Access to Capital – Borrow against policy values for tax-free corporate liquidity without affecting the underlying investment

Ensures Tax-Free Wealth Transfer – Death benefits flow tax-free to the corporation and can be distributed to shareholders tax-free through the Capital Dividend Account (CDA).

Beyond Tax Deferral: Protecting Your Corporate Wealth

The goal isn’t just delaying taxes—it’s eliminating unnecessary tax burdens. Implementing proactive strategies allows you to protect your hard-earned corporate wealth while creating sustainable financial security.

Your Action Plan

Assess your passive income exposure against the critical $50,000 threshold that triggers SBD reductions

Restructure high-tax investments toward capital-gains vehicles that reduce your passive income footprint

Evaluate corporate-owned insurance solutions as tax-exempt accumulation vehicles

Consult with a specialized tax professional familiar with BC's corporate tax environment

Most business owners focus on revenue growth but overlook tax efficiency. The most successful ones recognize that protecting what’s earned is just as crucial as generating new income.

By implementing these strategies today, you'll not only reduce your current tax burden but also create a more resilient financial foundation for your business's future.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.009] The Ultimate Guide to Canada’s Top Tax-Advantaged Accounts: TFSA, FHSA, and RRSP (2025)

Explore Canada's top tax-advantaged accounts—TFSA, FHSA, and RRSP—to optimize your financial strategy in 2025. Understand each account's features, tax benefits, and ideal uses to make informed decisions for your savings and investments.

Many Canadians struggle to navigate tax implications while trying to save for critical life goals, whether it's buying a first home, preparing for retirement, or building financial security. The complexities of tax planning can feel overwhelming. Fortunately, Canada offers powerful tax-advantaged accounts designed to help you keep more of your hard-earned money.

Comprehensive Account Comparison

Detailed Account Breakdown

1. Tax-Free Savings Account (TFSA)

The TFSA offers exceptional flexibility for short-term savings, long-term investments, or emergency funds.

Key Features:

Eligibility: Canadian residents aged 18+

2025 Contribution Limit: $7,000 (Unused contribution room carries forward)

Lifetime limit (2025): $102,000 for those eligible since 2009

Tax Advantages:

Non-tax-deductible contributions

Tax-free Investment growth and withdrawals

Ideal Uses:

Flexible savings for vacations, major purchases, and emergencies

Long-term investing with tax-free growth

Penalty-free withdrawals at any time

2. First Home Savings Account (FHSA)

Introduced in 2023, the FHSA combines the best features of TFSAs and RRSPs specifically for first-time homebuyers.

Key Features:

Eligibility: Canadian residents aged 18+ who haven't owned a home in the current or past four years

2025 Contribution Limit: $8,000 (Unused contribution room carries forward)

Lifetime limit (2025): $40,000

Tax Advantages:

Tax-deductible contributions

Tax-free withdrawals for a qualifying home purchase

Ideal Uses:

Accelerated savings for a first home

Maximized tax benefits while building your down payment

3. Registered Retirement Savings Plan (RRSP)

The RRSP remains Canada's primary retirement savings vehicle with additional benefits for homebuying and education.

Key Features:

Eligibility: Canadian residents with earned income

2025 Contribution Limit: 18% of previous year’s income (max $32,490)

Tax Advantages:

Tax-deductible contributions

Tax-deferred investment growth until withdrawal

Special withdrawal programs for homebuying and education

* Taxation on Withdrawals

When you withdraw from your RRSP (outside of the Home Buyers' Plan or Lifelong Learning Plan), your financial institution will deduct the withholding tax automatically:

10% on up to $5,000 (5% in Quebec)

20% on $5,001-$15,000 (10% in Quebec)

30% on over $15,000 (15% in Quebec)

* Special Programs

Home Buyers' Plan (HBP): Withdraw up to $60,000 tax-free for first home (Repayment within 15 years)

Lifelong Learning Plan (LLP): Withdraw up to $20,000 for education (Repayment within 10 years)

Ideal Uses:

Reducing taxable income in high-earning years

Retirement planning with potential access for homeownership or education

Strategic Use of These Accounts

Maximizing your savings and minimizing taxes often involves finding a balance that works for your financial situation. Here are some ways to consider combining these accounts based on different stages of life and goals:

Young Professionals

Prioritize TFSA for flexibility, short-term goals, and tax-free growth

Consider FHSA if homeownership is a goal

Mid-Career Individuals

Maximize RRSP contributions to reduce taxable income in higher tax brackets

Use TFSA for supplementary savings with future tax-free access

Plan RRSP withdrawals strategically to manage potential withholding taxes

First-Time Homebuyers

Combine FHSA and RRSP (through the Home Buyers' Plan) to maximize down payment potential

Supplement with TFSA for additional flexibility

Retirement Planners

Maintain regular RRSP contributions for long-term growth and immediate tax benefits

Use TFSA for tax-free retirement income to complement RRSP withdrawals

Develop RRSP withdrawal strategy to minimize the impact of withholding taxes and overall tax liability

Pro Tips for Maximizing Your Accounts

Financial planning isn't about perfection—it's about progress. These tax-advantaged accounts are powerful tools, but the most important investment is your understanding and consistent strategy. As you navigate your financial journey, keep these key principles in mind:

1. Understand Your Personal Tax Situation

Contributions impact differently based on income

Consider consulting a financial advisor

2. Don't Treat Accounts in Isolation

View them as complementary tools

Balance between immediate flexibility and long-term goals

3. Regular Review and Rebalancing

Reassess your strategy annually

Adjust contributions based on life changes

Your financial journey is unique. What works for others might not be your ideal path. The goal is not to follow a universal blueprint, but to create a strategy that aligns with your personal financial aspirations and lifestyle.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.008] Accelerating Financial Growth with Strategic Leveraging

Explore how strategic leveraging can fast-track financial goals with tax efficiency, investment opportunities, and disciplined savings. Learn who benefits and build your tailored strategy today!

In the world of wealth management, time is often considered your greatest ally. While the magic of compounding requires patience, what if you could shorten this journey and achieve financial success even faster?

Leveraging is an investment strategy that allows you to borrow money to invest, thereby enhancing potential returns and helping you reach your financial goals more swiftly. Though the concept may seem daunting at first, leveraging can be both effective and manageable when approached with the right guidance.

What is Strategic Leveraging?

At its essence, leveraging means utilizing borrowed money to make investments. By accessing capital beyond personal savings, you can aim for higher returns. While this might sound complex, the principle is similar to buying a house with a mortgage – you're using borrowed money to invest in an asset that has the potential to grow in value over time.

However, it requires an understanding of both the investment landscape and the risks involved, making it essential to approach this strategy with care and precision.

Why Consider Leveraging in Your Financial Strategy?

The appeal of leveraging lies in its potential to amplify your investment returns. However, it's not just about potential gains. When structured properly, leveraging can offer several strategic advantages.

Tax Efficiency

One of the most compelling benefits of leveraging is the potential to deduct interest on loans used for investment purposes. According to the Canada Revenue Agency (CRA), interest on such loans can generally be deducted if the borrowed funds are used to generate income like dividends or interest. However, staying informed about evolving tax laws is critical to maximizing this benefit.

Enhanced Investment Opportunities

Leveraging can open doors to investment opportunities that might otherwise be out of reach. It allows you to:

Diversify your portfolio more broadly

Take advantage of timely investment opportunities

Access sophisticated investment strategies typically reserved for larger portfolios

Who Should Consider Strategic Leveraging?

Leveraging isn't a one-size-fits-all solution, but it can be particularly valuable for:

High-Income Earners: High-income individuals often face limitations on their Registered Retirement Savings Plan (RRSP) contributions. Leveraging provides an opportunity to invest beyond these constraints, enabling broader financial growth.

Investors with Non-Registered Portfolios: Those investments outside of registered accounts, along with non-deductible debts such as mortgages or car loans, can strategically leverage their situation to optimize tax savings.

Holders of Permanent Life Insurance: By combining a permanent life insurance policy with a leverage loan, clients can benefit from tax-deductible insurance premiums and defer capital gains taxes upon death.

Small Business Owners: Business owners looking to remove retained earnings from their companies can leverage these funds to invest in a tax-efficient manner, mitigating substantial tax bills.

New Investors: For individuals beginning to take savings seriously, leveraging can represent an advantageous option. With a long-term investment horizon, new investors can take advantage of compounding effects while the obligation of loan repayments can help establish a disciplined savings habit.

Building a Strategic Leveraging Plan

The key to successful leveraging lies in careful planning and execution:

Step 1: Assessment

Work with a financial planner to evaluate your:

Risk tolerance

Cash flow stability

Investment objectives

Time horizon

Step 2: Strategy Development

Create a comprehensive plan that includes:

Investment selection

Risk management measures

Tax optimization strategies

Regular monitoring and rebalancing protocols

Step 3: Implementation and Monitoring

Execute your strategy with regular reviews to ensure it continues to align with your financial goals and market conditions.

Is Leveraging Right for You?

Strategic leveraging can be a powerful tool for accelerating wealth building, but it's not suitable for everyone. Success requires careful consideration of key factors. Market fluctuations, interest rate changes, and ongoing repayment obligations create inherent risks that must be managed through:

A clear understanding of the strategy

Comfort with taking calculated risks

Strong cash flow management

A long-term perspective

Professional guidance

Moving Forward with Confidence

If you're considering leveraging as part of your financial strategy, the key is to start with a thorough understanding and professional guidance. Remember, the most successful investment strategies are those that align with your personal financial goals, risk tolerance, and long-term objectives. Contact us to learn more about how strategic leveraging might fit into your wealth-building journey.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.007] Mastering Tax Planning in Canada

Discover the keys to effective tax planning in Canada. Learn strategies to minimize liabilities, maximize deductions, and optimize your financial future with expert guidance.

Tax planning is a cornerstone of financial stability, yet it often gets overlooked. By effectively managing your taxes, you can reduce liabilities, increase savings, and redirect those funds toward investments that build your future wealth.

This guide highlights the importance of tax planning and provides practical insights tailored to diverse financial situations. Whether you’re looking to optimize savings, navigate Canada’s tax system, or secure long-term financial goals, proactive tax strategies can make a lasting difference.

The Fundamentals of Canadian Tax Planning

To make the most of your tax planning strategies, a clear understanding of how the tax system works is essential. In Canada, the progressive tax system, administered by the Canada Revenue Agency (CRA), is designed so that higher income results in higher tax rates.

The system includes both federal and provincial income taxes. Federal taxes are applied across several income brackets to fund national expenditures, while each province, including British Columbia, sets its own tax brackets and rates. These provincial rates are subject to annual adjustments, such as changes in the number of brackets or threshold amounts.

To simplify the complexity of separate tax structures, combined income tax rate tables provide a clear overview of total rates for each income level. The graph below illustrates the 2024 federal and provincial tax brackets for British Columbia, showcasing how marginal tax rates apply to different levels of taxable income.

Why Tax Planning is a Game-Changer

Taxes are a fact of life, but how you manage them can make a significant difference in your financial future.

Effective tax planning empowers you to:

Reduce Your Tax Burden: By taking advantage of tax-saving opportunities, you can lower your taxable income and keep more of your earnings.

Maximize Government Benefits: Many programs, such as the Canada Child Benefit (CCB) or GST/HST refunds, offer valuable financial relief.

Optimize Your Investments: Tax-advantaged accounts like RRSPs and TFSAs allow your money to grow tax-free or tax-deferred, improving returns over time.

Increase Financial Security: Managing taxes strategically ensures your resources are working efficiently to support your long-term goals.

Who Benefits from Tax Planning

Tax planning isn’t just for the wealthy—it’s for everyone. No matter your income level or life situation, tailored strategies can help you maximize financial benefits.

High-Income Earners (T4)

For professionals and executives, tax planning can make a substantial impact:

RRSP Contributions: Reduce taxable income and potentially increase your tax refund.

RRSP Loans: Use loans to maximize RRSP contributions and gain immediate tax relief.

FHSA Contributions: Save for your first home with tax-deductible contributions.

Investment Loans: Deduct interest on eligible loans to lower your tax bill.

Families with Young Children

Families can reduce their tax burden while planning for the future:

Canada Child Benefit (CCB): Receive tax-free payments of up to $648 to support child-related expenses.

Spousal RRSP Contributions: Split income in retirement to lower overall taxes.

Childcare Subsidy: Access up to $1,250 to help cover daycare costs.

RESP Contributions: Save for your children’s education with government grants.

GST/HST Refund: Qualify for direct financial relief through refundable tax credits.

Post-Secondary Students

Students can start building their financial foundation early:

Tuition Tax Credits: Offset future taxes by keeping track of tuition payments.

GST/HST Refunds: Ease financial strain with annual refunds, including up to $519.

TFSA Contributions: Begin investing with tax-free growth potential.

Low-Income Earners

Even with modest income, tax planning offers opportunities to improve financial health:

Canada Workers Benefit (CWB): Access refundable tax credits for additional support with up to $2,616.

GST/HST Refunds: Benefit from direct cash refunds to boost cash flow.

The Hidden Cost of Taxes on Investments

Tax planning extends beyond income; it also protects your investments. Without proper strategies, taxes can severely erode long-term returns. For example, a $1 investment growing to $1,048,576.00 without taxes could shrink dramatically with a 40% tax rate ($12,089.26). Refer to the graph below and click the arrow to clearly see the difference for yourself.

Have you noticed the striking difference? It’s a challenge many investors face, but the good news is that there are effective strategies to overcome it.

Using tax-advantaged accounts like RRSPs and TFSAs allows your investments to grow without the drag of taxation, significantly boosting your long-term financial outcomes.

Take the Next Step

Tax planning isn’t a one-time activity—it’s an ongoing process that evolves alongside your financial situation. By taking a proactive approach, you can minimize what you owe, keep more of your hard-earned income, and align your taxes with your long-term financial goals.

As tax laws are constantly evolving, staying informed about these changes allows you to make decisions that optimize your financial outcomes. Working with a financial planner or tax specialist can help uncover overlooked opportunities and ensure your strategies remain effective.

Start small, but start now—building these habits today will lead to greater financial resilience in the future.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.006] Navigating Economic Uncertainty: Wealth Strategies to Counter Inflation

Discover a holistic approach to financial planning with the Financial Planning Pyramid. This blog explains how to build a strong financial foundation by addressing key areas like emergency savings, investments, tax strategies, retirement, and estate planning.

In today’s dynamic economic environment, protecting and growing wealth amid persistent uncertainty has become increasingly complex. Global markets remain volatile, with rapidly shifting economic indicators often requiring a reassessment of traditional investment strategies. For Canadians, these dual pressures of market fluctuations and economic unpredictability emphasize the importance of adopting practical and systematic wealth management approaches.

To address these challenges, implementing strategic wealth preservation techniques and investment strategies tailored for volatile conditions is essential. In this post, we delve into the impact of inflation and explore how consistent approaches like dollar-cost averaging can enhance portfolio resilience, providing actionable strategies for achieving long-term financial stability.

Inflation: Safeguarding Your Wealth

Inflation gradually erodes the purchasing power of your money, impacting everything from daily expenses to long-term savings and investments. Over the past 20 years, Canada Inflation Rate has fluctuated significantly, ranging from a high of 6.8% in 2022—driven by global economic pressures—to periods of near-zero inflation, such as in 2009 and 2015 during major economic downturns. Being aware of its effects and adopting proactive strategies is essential for maintaining financial stability.

How Inflation Affects You

Purchasing Power: Inflation reduces what your money can buy over time. For instance, $100 today may have less value in a few years, underscoring the importance of investments that outpace inflation.

Interest Rates: Rising inflation typically drives up interest rates, making mortgages and loans more costly. Homeowners with variable rates may see increased payments, while rent can also climb as landlords adjust to higher expenses.

Budgeting Challenges: Inflation adds unpredictability to future costs, making it harder to plan for goals like retirement or education.

Wealth Preservation Strategies

Diversify Your Portfolio: A blend of stocks, bonds, real estate, and other assets can help balance returns and manage inflation risk.

Upskill and Increase Income: Negotiating for wage increases or advancing your skills can help you keep pace with living costs.

Strategic Savings: Consider laddering your savings across high-interest accounts or short-term investments to maximize returns while maintaining access to cash.

Dollar-Cost Averaging (DCA): A Consistent Investment Strategy

Dollar-cost averaging (DCA) is a steady, low-stress investment approach that involves investing a fixed amount at regular intervals, regardless of market conditions. Unlike lump-sum investing, DCA helps smooth out market fluctuations by spreading investments over time, making it particularly advantageous for long-term investors.

For example, instead of investing $1,000 at once, DCA suggests investing $200 monthly over 5 months. This method helps buy more shares when prices are low and fewer when prices are high, effectively averaging your cost per share. This approach can be especially beneficial in volatile markets, helping investors stay focused on their long-term goals without reacting emotionally to short-term shifts.

While DCA doesn’t guarantee higher returns, it promotes consistent investing, reducing decision fatigue and market timing pitfalls. This systematic approach empowers investors to build wealth with confidence and clarity, making DCA an effective choice for those aiming for gradual wealth accumulation.

Building Financial Resilience: From Strategy to Action

The impact of inflation on personal wealth remains a critical consideration for every Canadian investor. While inflation presents challenges, it also creates opportunities for those who approach it strategically. By implementing a diversified investment approach, maintaining consistent investment practices through DCA, and actively managing your income potential, you can build a robust defense against inflation's erosive effects.

As markets evolve and economic conditions shift, staying informed and regularly reviewing your financial strategy will be key to maintaining and growing your wealth in real terms. Remember that wealth preservation is not about finding a single perfect strategy but creating a balanced, adaptable approach that aligns with your long-term financial goals. It's crucial to clearly assess your financial situation, objectives, and risk tolerance to find the most suitable approach for you.

DIEM is here to help you effectively navigate this process. Take action today to secure your financial tomorrow—your future self will thank you for it.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.005] Building a Strong Financial Foundation: A Holistic Approach to Wealth Management

Build a resilient financial future with a holistic wealth management approach. This blog introduces the Financial Planning Pyramid, covering key aspects like emergency funds, risk management, investments, tax strategies, retirement, and estate planning.

The path to lasting financial success requires more than just smart investments. While many focus exclusively on market returns, true wealth management encompasses a broader spectrum of financial planning elements that work together to create lasting prosperity.

A well-structured financial strategy integrates emergency planning, risk management, tax optimization, and estate planning alongside traditional investment approaches. This comprehensive framework not only provides stability during market fluctuations but also establishes the foundation needed for sustained wealth accumulation and preservation across generations.

The Financial Planning Pyramid: A Blueprint for Financial Security

The Financial Planning Pyramid provides a systematic approach to building this holistic strategy, emphasizing the importance of establishing strong fundamentals before pursuing more advanced financial objectives. Each layer of the pyramid serves a distinct purpose while supporting the levels above it, creating an interconnected system that adapts to changing financial circumstances and goals.

Financial Position

At the foundation of the pyramid is your financial position, which includes emergency savings, debt management, and liquidity. This layer emphasizes the need for accessible cash reserves to cover unexpected expenses, ensuring financial stability without relying on credit or liquidating investments.

Risk Management

Next is risk management, which protects against setbacks caused by unforeseen events. Having the right insurance—such as life, health, and disability—creates a safety net that allows you to maintain stability through challenging times without compromising your long-term goals.

Wealth Accumulation

With a secure financial base, you can shift focus to wealth accumulation. Here, you explore investment options like employer-sponsored retirement plans, insured retirement accounts, and taxable investment accounts. Portfolio diversification and risk alignment are critical at this stage to maximize growth potential while staying aligned with your goals.

Tax Planning

Tax planning is an essential element that enhances the effectiveness of every layer in the pyramid. Strategic tax management can increase the efficiency of your financial plan, affecting both growth and wealth preservation. Incorporating tax considerations early on can yield benefits over time.

Retirement Planning

Retirement planning becomes more central as you advance financially, involving detailed strategies for generating sufficient retirement income. This includes planning anticipated expenses, managing retirement accounts, and understanding the implications of government benefits like OAS (Old Age Security) and CPP(Canada Pension Plan).

Estate Planning

At the top of the pyramid is estate planning, which ensures assets are distributed according to your wishes. This layer encompasses more than just a will; it includes beneficiary designations, medical directives, and potential trusts, providing for efficient transfer of wealth while considering potential tax impacts for beneficiaries.

Beyond the Pyramid: Integrating Financial Success

The financial planning pyramid serves as more than just a theoretical framework—it represents the interconnected nature of wealth management. Each layer builds upon and reinforces the others, creating a dynamic system that evolves with your financial journey. Understanding these relationships enables more effective decision-making and resource allocation across all aspects of your financial life.

The true power of holistic wealth management lies in its ability to address both immediate needs and long-term aspirations. By maintaining focus on all elements of the financial pyramid simultaneously, you create a resilient financial structure capable of weathering market volatility, life changes, and economic uncertainties. This comprehensive approach ensures that your wealth management strategy remains aligned with your goals while adapting to changing circumstances and opportunities.

Moreover, the pyramid framework emphasizes the importance of sequential development in financial planning. Just as a physical pyramid requires a solid foundation to support its upper levels, your financial strategy must be built on stable ground. This methodical approach helps prevent the common pitfall of pursuing advanced investment strategies before establishing fundamental financial security.

As markets evolve and financial products become increasingly complex, maintaining this holistic perspective becomes even more crucial. It allows you to evaluate new opportunities within the context of your overall financial structure, ensuring that decisions enhance rather than compromise your financial stability. This balanced approach to wealth management provides the framework needed to build and preserve wealth effectively across generations.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.004] The Secret to Wealth-Building: Unlocking the Power of Time

Discover the secret to wealth-building by leveraging time. Learn how starting early, understanding compound interest, and applying the Rule of 72 can dramatically enhance your financial growth.

In today's economic landscape, Canadians face mounting financial strain - from persistent inflation and soaring housing costs to the challenge of living paycheck to paycheck. While these pressures can make planning for the future seem daunting, they actually underscore the critical importance of strategic financial planning. The key lies not in finding a universal solution, but in developing a personalized approach that addresses your unique circumstances and goals.

Financial independence begins with mastering fundamental concepts. This knowledge serves as your foundation, enabling you to evaluate your current position, identify opportunities for growth, and craft strategies that align with both personal and professional financial objectives. Without these essential principles, you might miss crucial opportunities for building long-term wealth and financial security.

By understanding and applying these core concepts, you can create a robust financial plan that not only provides stability but also adapts to life's changes, giving you the confidence to navigate any financial challenge.

The Power of Starting Early: Time is Your Greatest Asset

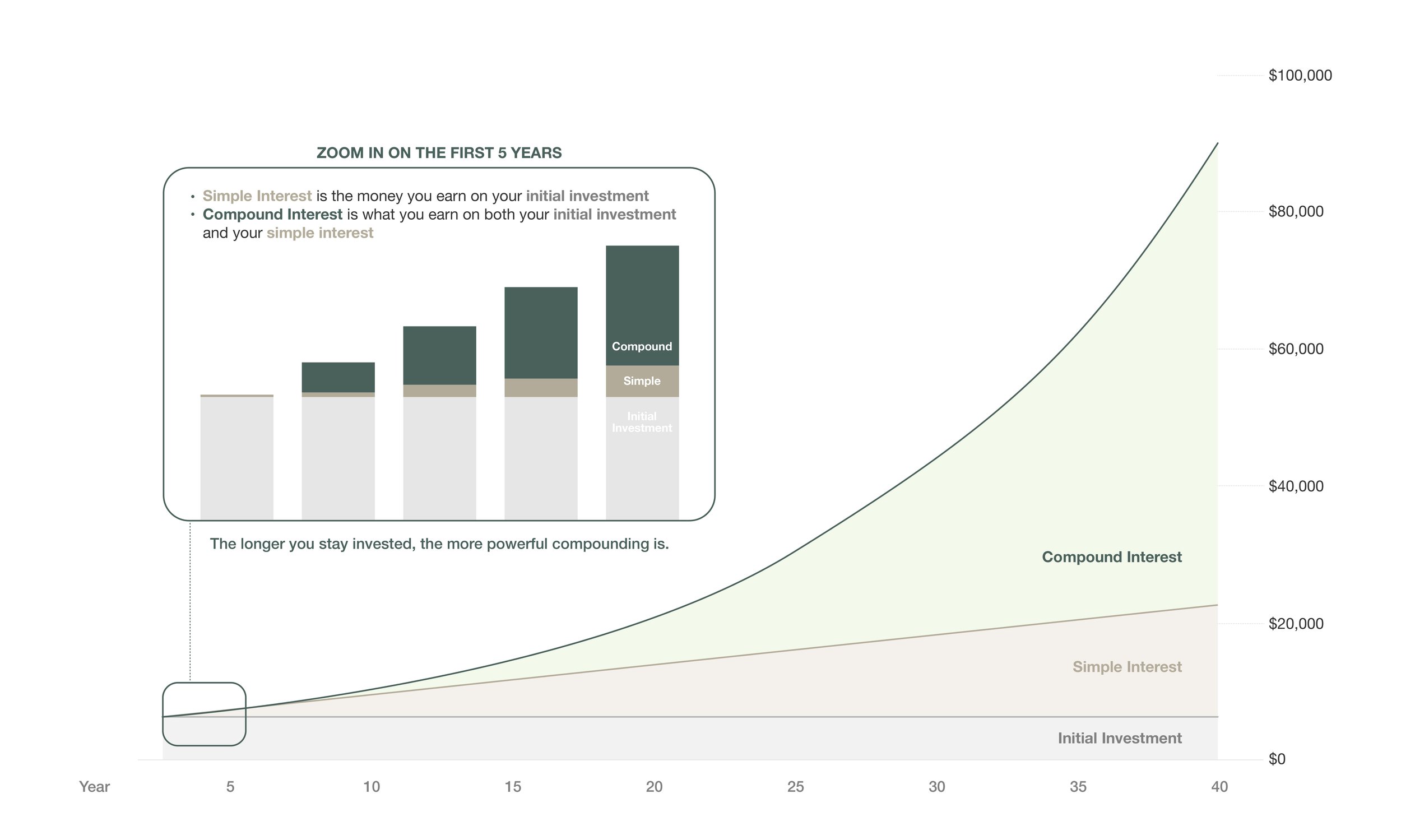

The most compelling principle in wealth-building is the impact of time. The earlier you start saving and investing, the greater your money's growth over time. This growth is driven by compound interest, where your investment’s interest generates its own earnings.

Consider this: investing $2,000 annually from ages 22 to 27 can yield significantly more retirement savings than investing the same amount from ages 28 to 62. This dramatic difference stems from compound growth - your money grows not just from your initial investment, but from years of accumulated returns. The power of this effect will become clearer in the graph that follows.

The impact of early investing becomes even more crucial when considering today's retirement needs. BMO's 13th Annual Retirement Study revealed that Canadians now estimate they need $1.7 million to retire, a 20% increase from the $1.4 million reported in 2020. This rising benchmark emphasizes the urgency of early action. While delaying savings limits your growth potential, starting early - even with modest contributions - leverages time to build substantial wealth.

Understanding Rate of Return: Your Growth Catalyst

Your investment's rate of return fundamentally impacts your wealth-building journey. Higher returns can boost growth, but they often come with increased risk. The goal is to strike a balance that aligns with your objectives.

The Rule of 72 offers a practical way to understand investment growth. By simply dividing 72 by your expected annual return rate, you get a rough estimate of how many years it will take for your investment to double in value. For example, if you're expecting a 6% annual return, this calculation shows that your investment would likely double in about 12 years (72 ÷ 6). The graph below demonstrates the Rule of 72 in action, showing how investments grow at different annual return rates—3%, 6%, and 12%.

In financial planning, understanding the Rule of 72 is essential for several reasons:

Setting Realistic Goals: Knowing the timeline for investment growth allows you to set achievable financial goals, like saving for retirement, a home, or other major milestones.

Encouraging Early Investment: The longer your money is invested, the more compounding can enhance your future wealth. Delaying investments limits the long-term growth of your savings.

Evaluating Investment Options: Applying the Rule of 72 helps evaluate different opportunities and make informed choices based on risk tolerance and goals.

The Rule of 72 becomes even more powerful with compound interest, as interest earned compounds over time, resulting in exponential rather than linear growth. To illustrate this dramatic difference, consider a single investment of $6,000: With simple interest at 7% annually, your money grows steadily but modestly. However, with compound interest at the same rate, that $6,000 could grow to approximately $90,000 over 40 years – a striking demonstration of earning money on the money you earn. Looking at the graph below, you can see this remarkable contrast between simple and compound interest, where the compound interest line curves upward dramatically while simple interest follows a straight path.

Your Financial Success Starts Now

A financial plan tailored to your unique needs does more than provide stability; it enables you to seize opportunities and face future uncertainties with confidence. The principles covered today – early investing, compound interest, and the Rule of 72 – serve as stepping stones to financial freedom. While the current economic climate may present challenges, these fundamentals are powerful tools for building lasting wealth. Remember, it’s not about how much you start with, but how soon you begin.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.003] Independent vs Bank Financial Planner

Discover the key differences between Independent Financial Planners and Bank Financial Planners to make an informed decision about your financial future.

Securing your financial future is a critical decision, and selecting the right financial planner is crucial to that process.

When considering your options, it’s essential to differentiate between Independent Financial Planners and Bank Financial Planners. While both professionals aim to understand your financial objectives and provide tailored services, they differ significantly in their scope of work and approach.

Let’s explore these key similarities and differences, so you can choose the financial professional that best aligns with your needs.

Independent Financial Planner vs Bank Financial Planner

Commonalities

Supporting Financial Goals: Both types of planners help clients set and achieve their financial goals.

Offering Financial Services: They provide a range of services, including financial planning, tax planning, investment advice, risk & insurance management, and retirement planning.

Conducting Client Consultations: They analyze clients' financial situations, goals, and risk tolerance to deliver tailored financial advice.

Complying with Regulations: Both are regulated by financial authorities in their respective regions and must adhere to industry standards and legal requirements.

Maintaining Expertise and Qualifications: Both professionals possess relevant education and professional qualifications in finance, economics, and financial planning.

Key Differences

1. Scope of Services:

Bank Financial Planner: Primarily offers financial products and services tied to their bank, such as deposit accounts, credit cards, loans, and investment products.

Independent Financial Planner: Provides a comprehensive suite of financial services from various providers, including investment management, tax planning, retirement and estate planning, and risk management.

2. Client Relationship:

Bank Financial Planner: Engages in short-term, product-specific interactions.

Independent Financial Planner: Fosters long-term relationships, providing ongoing support and personalized advice.

3. Product Range:

Bank Financial Planner: Limited to a specific set of products offered by their bank.

Independent Financial Planner: Delivers curated financial plans, selecting from a broad array of resources to best meet client needs.

4. Expertise and Approach:

Bank Financial Planner: Specializes in the bank’s products, often promoting these specific solutions.

Independent Financial Planner: Provides a comprehensive approach, leveraging broad financial knowledge to offer unbiased, independent advice across a wide range of financial needs.

5. Customization:

Bank Financial Planner: Aligns solutions with the bank’s policies.

Independent Financial Planner: Delivers tailored solutions designed to closely match your unique financial situation, offering objective advice as they are not tied to any specific institution or product.

Choosing the right financial planner is key to achieving your financial goals. While Bank Financial Planners may offer familiarity with their institution’s products, Independent Financial Planners provide a broader, unbiased approach tailored to your unique needs.

At DIEM Financial Planning, we pride ourselves on delivering independent, personalized financial advice that puts your interests first. Whether you're planning for retirement, managing investments, or navigating complex financial decisions, our experienced team is here to guide you. Partner with us to build a financial future that truly reflects your aspirations!

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.002] Financial planning Process

Explore the main steps in the financial consultation process, from the initial meeting to ongoing support.

We’ll now explore the essential components of the financial planning process, giving you a clear picture of what to expect when working with a financial planner. From your first consultation to ongoing support, we'll guide you through the steps that ensure your financial plan is comprehensive, personalized, and adaptable to your evolving needs.

Whether you're new to financial planning or seeking to refine your existing strategy, this guide offers valuable insights to help you make informed decisions.

meetings designed for you

Our meetings are designed to deeply understand your specific financial circumstances, goals, and preferences. Here’s what we prioritize during these sessions.

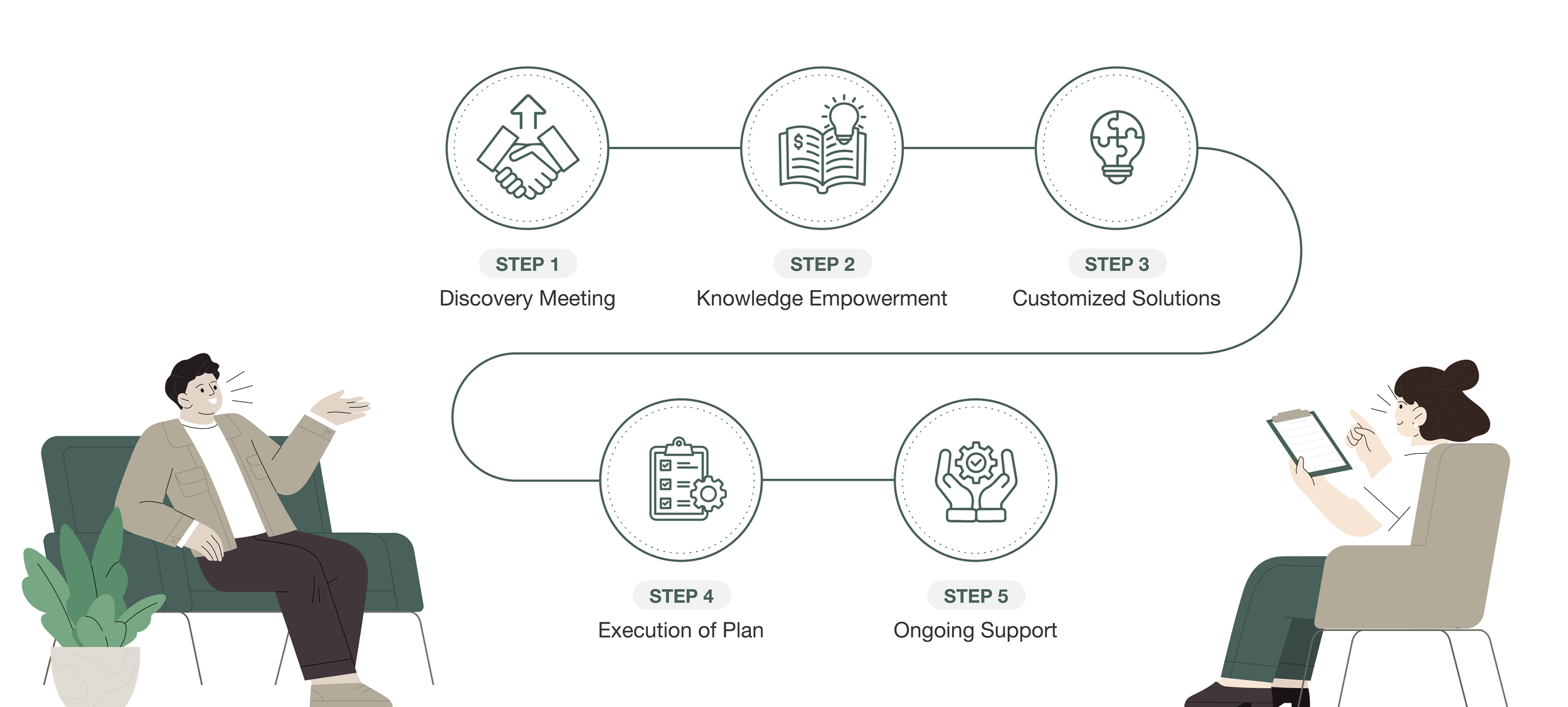

Our Financial planning Process

STEP1. Discovery Meeting

Our first meeting is all about laying a strong foundation for our partnership. We use a simplified financial survey to pinpoint your key financial objectives and priorities. This process helps us establish where you stand currently, so we can set the groundwork for your financial plan. The survey is conducted in writing and includes the following content:

Financial Survey Content (Example)

Personal financial habits

Financial goals

Concerns about financial management

Experience with financial management tools

Areas of interest in financial management

STEP 2. Knowledge Empowerment

Once we have a thorough understanding of your financial situation, we focus on empowering you with knowledge. We break down the pros and cons of various financial products, simplify complex financial regulations, and equip you with the tools to make informed decisions. This phase is critical in helping you make the best financial choices on your own.

- Basic Financial Concepts -

1. CRA (Canada Revenue Agency)

The government agency responsible for managing and collecting taxes in Canada.

2. Rule of 72

A rule of thumb to estimate the number of years required for an investment to double with compound interest.

3. Dollar Cost Averaging (DCA)

An investment strategy where you regularly invest a fixed amount, helping to reduce the impact of market volatility.

4. Financial Pyramid

A model that categorizes investments into layers based on risk, starting with low-risk assets at the bottom and higher-risk investments at the top.

5. How Money Works

A set of concepts related to earning, spending, saving, and investing money effectively.

6. Leveraging

A strategy of using borrowed funds to potentially increase returns.

7. The Big Picture

An overall financial plan and strategy designed to achieve your long-term financial goals.

8. Water Bowl Model (Tax, Inflation, Returns, Time, Income)

A conceptual model that uses the analogy of a water bowl to explain how various factors like taxes, inflation, returns, time, and income interact in financial management.

STEP 3. Customized Solutions

After analyzing your financial details, we offer customized solutions and strategies that align with your objectives. Whether it's maximizing tax returns, enhancing investment returns, or planning for real estate savings and retirement, we provide expert advice to help you reach your goals effectively.

STEP 4. Execution of Plan

With a clear strategy in place, we move forward with implementation. We work alongside a team of professionals, such as accountants, lawyers, and bankers, to ensure that every aspect of your financial plan is executed seamlessly.

STEP 5. Ongoing Support

In financial planning, our commitment to you truly begins when your plan is set in motion. We provide ongoing support, guiding you through both successes and challenges, and ensuring your financial decisions regarding investments, taxes, insurance, and other matters are well-informed. We maintain regular communication to ensure your financial plan evolves as your circumstances change.

Financial planning is an ongoing process that adapts to your evolving needs and goals. From our initial discovery meeting to the continuous support we provide, every step is designed to ensure your financial plan is comprehensive, personalized, and effective. By partnering with us, you gain not only a tailored strategy but also the knowledge and guidance needed to make informed decisions and confidently navigate your financial future. Let us help you take the first step toward financial success.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.001] Understanding Financial Planning

Learn the importance of financial planning in Canada and explore how we can guide you toward financial success.

Welcome to DIEM Financial Planning!

Our name, DIEM, reflects our commitment to making the most of each day by seizing opportunities and focusing on daily growth. We believe in taking proactive steps every day toward financial success.

We understand that life can be unpredictable. From navigating complex tax issues to managing unexpected financial challenges, our mission is to provide comprehensive financial planning that offers peace of mind and long-term security. Our goal is to craft a financial plan that not only addresses your current needs but also safeguards you against future uncertainties, allowing you to focus on what matters most.

Let’s explore how expert financial planning can be a game-changer in achieving your financial goals.

How We Help You with Financial Planning

Financial planning is more than just managing your money—it's about securing your future. We’re dedicated to guiding you through every aspect of your financial journey. This includes making informed decisions about banking, investment management, insurance, retirement planning, and tax optimization. Our approach is tailored to your unique goals and circumstances, ensuring that your financial plan reflects your distinct needs and aspirations.

Why Financial Planning is Essential

We understand the unique financial landscape of Canada and the challenges it presents:

Navigating Canada’s Complex Tax System: Our expertise helps you take full advantage of tax benefits while minimizing your tax burden, ensuring that your finances are optimized.

Building a Diverse Investment Portfolio: With a wide array of financial products available in Canada, we’ll help you create a customized investment strategy that balances risk and aligns with your financial goals.

Securing Your Retirement: Planning for retirement can be daunting, but with our guidance, you can be confident in your preparations. We’ll help you develop a plan that ensures you have the resources needed to enjoy your retirement years.

Managing Economic Uncertainty: In times of economic volatility, we provide strategies to protect your financial stability and manage potential risks.

Personalized Financial Plans: We understand that one size doesn’t fit all. That’s why we offer customized plans that reflect your unique financial goals and life circumstances.

Staying Current with Evolving Financial Regulations: As regulations change, we help you stay informed and adjust your plans to remain compliant and current.

Our Commitment to Your Financial Success

At DIEM Financial Planning, we believe in the power of collaboration. We work with a network of experts, including lawyers, accountants, and real estate professionals, to provide you with a comprehensive financial management experience. Our team approach ensures that you receive well-rounded advice tailored to your needs.

We’re here to answer any questions or concerns you may have about your finances. Whether you're seeking guidance on a specific issue or looking to build a robust financial plan, we’re committed to helping you achieve your financial goals. Stay tuned for more insights and stories designed to empower your financial future.

Thank you for considering DIEM Financial Planning as your partner in financial success. We look forward to working with you.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee