[vol.010] Smart Tax Strategies for Small Business Owners in BC

Structuring corporate finances efficiently is pivotal to long-term success. A key element of this financial optimization involves the management of corporate earnings, which presents a dual aspect: while retaining earnings within a corporation offers significant tax advantages, these same accumulated funds, when classified as passive income exceeding certain thresholds, can trigger substantially higher tax rates that ultimately diminish overall profitability.

By understanding passive income taxation and adopting strategic financial planning approaches tailored to these realities, business owners can maximize their after-tax income, safeguard hard-earned assets, and ensure long-term financial stability in an ever-changing tax environment.

Why Retain Earnings in a Corporation?

Incorporating as a Canadian-Controlled Private Corporation (CCPC) grants access to the Small Business Deduction (SBD), reducing the tax rate on the first $500,000 of active business income (ABI).

Small Business Tax Advantage in BC (2025 Rates):

Active Business Income (up to $500,000): 11% tax rate

General Corporate Rate (if SBD is lost): 27% tax rate

This preferential tax treatment enables business owners to reinvest earnings within the corporation, rather than withdrawing profits and paying up to 53.5% in personal tax.

However, accumulating too much passive income can shrink or eliminate the SBD, leading to significantly higher corporate taxes.

Understanding Passive Income Taxation

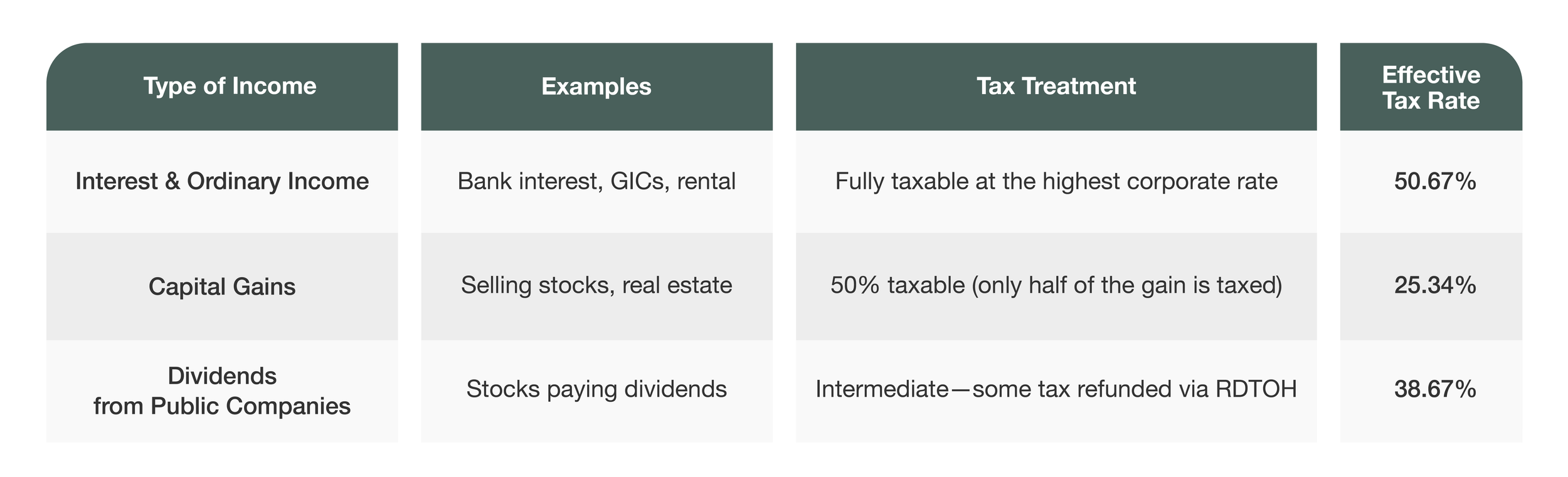

When a corporation earns investment income (passive income), it is taxed differently than active business income. Some income types are taxed at much higher rates, while others benefit from preferential tax treatment.

Among them, interest and rental income face the highest tax burden (50.67%), making them the least efficient corporate investments. Choosing lower-taxed investments like capital gains can help minimize corporate tax burdens.

Tax Treatment of Passive Income in BC (2025 Rates):

How Passive Income Can Double Your Corporate Tax Rate

Since 2019, businesses accumulating over $50,000 in passive income face a steep tax penalty, often overlooked by corporations building investment portfolios. This rule can unexpectedly increase tax rates from 11% to 27%, resulting in a substantial tax burden.

How the SBD Reduction Works:

Below $50,000 → No impact (SBD fully available).

Above $50,000 → SBD starts shrinking ($5 reduction for every $1 over the limit).

At $150,000+ → SBD is fully eliminated (corporate tax rate jumps from 11% to 27%).

Real-World Example:

A BC corporation with $600,000 in active income and $100,000 in passive income.

Passive income exceeds threshold by $50,000

SBD reduction: $50,000 × 5 = $250,000

Only $250,000 of active income(ABI) qualifies for the 11% rate ($27,500 tax)

Remaining $350,000($600,000-$250,000) taxed at 27%, instead of 11% ($94,500 tax)

Passive income of $100,000 is taxed at an assumed investment income rate of ~50% ($50,000 tax)

Total tax: $172,000

However, with proper planning to keep passive income below the $50,000 threshold, this business would have paid only $107,000 in tax. This passive income penalty results in $65,000 of unnecessary tax.

Strategic tax planning isn't optional – it's essential for protecting your hard-earned business profits.

Tax-Efficient Strategies to Reduce Passive Income Tax

1. Prioritize Capital Gains Over Interest Income

Invest in assets that appreciate over time rather than those that generate heavily taxed interest income.

2. Leverage Corporate-Owned Life Insurance

This powerful strategy goes beyond just reducing taxes—it can eliminate them:

Preserves Your Small Business Deduction – Growth accumulates tax-free without generating passive income that would trigger SBD clawbacks

Creates Tax-Free Access to Capital – Borrow against policy values for tax-free corporate liquidity without affecting the underlying investment

Ensures Tax-Free Wealth Transfer – Death benefits flow tax-free to the corporation and can be distributed to shareholders tax-free through the Capital Dividend Account (CDA).

Beyond Tax Deferral: Protecting Your Corporate Wealth

The goal isn’t just delaying taxes—it’s eliminating unnecessary tax burdens. Implementing proactive strategies allows you to protect your hard-earned corporate wealth while creating sustainable financial security.

Your Action Plan

Assess your passive income exposure against the critical $50,000 threshold that triggers SBD reductions

Restructure high-tax investments toward capital-gains vehicles that reduce your passive income footprint

Evaluate corporate-owned insurance solutions as tax-exempt accumulation vehicles

Consult with a specialized tax professional familiar with BC's corporate tax environment

Most business owners focus on revenue growth but overlook tax efficiency. The most successful ones recognize that protecting what’s earned is just as crucial as generating new income.

By implementing these strategies today, you'll not only reduce your current tax burden but also create a more resilient financial foundation for your business's future.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee