[VOL.002] Financial planning Process

We’ll now explore the essential components of the financial planning process, giving you a clear picture of what to expect when working with a financial planner. From your first consultation to ongoing support, we'll guide you through the steps that ensure your financial plan is comprehensive, personalized, and adaptable to your evolving needs.

Whether you're new to financial planning or seeking to refine your existing strategy, this guide offers valuable insights to help you make informed decisions.

meetings designed for you

Our meetings are designed to deeply understand your specific financial circumstances, goals, and preferences. Here’s what we prioritize during these sessions.

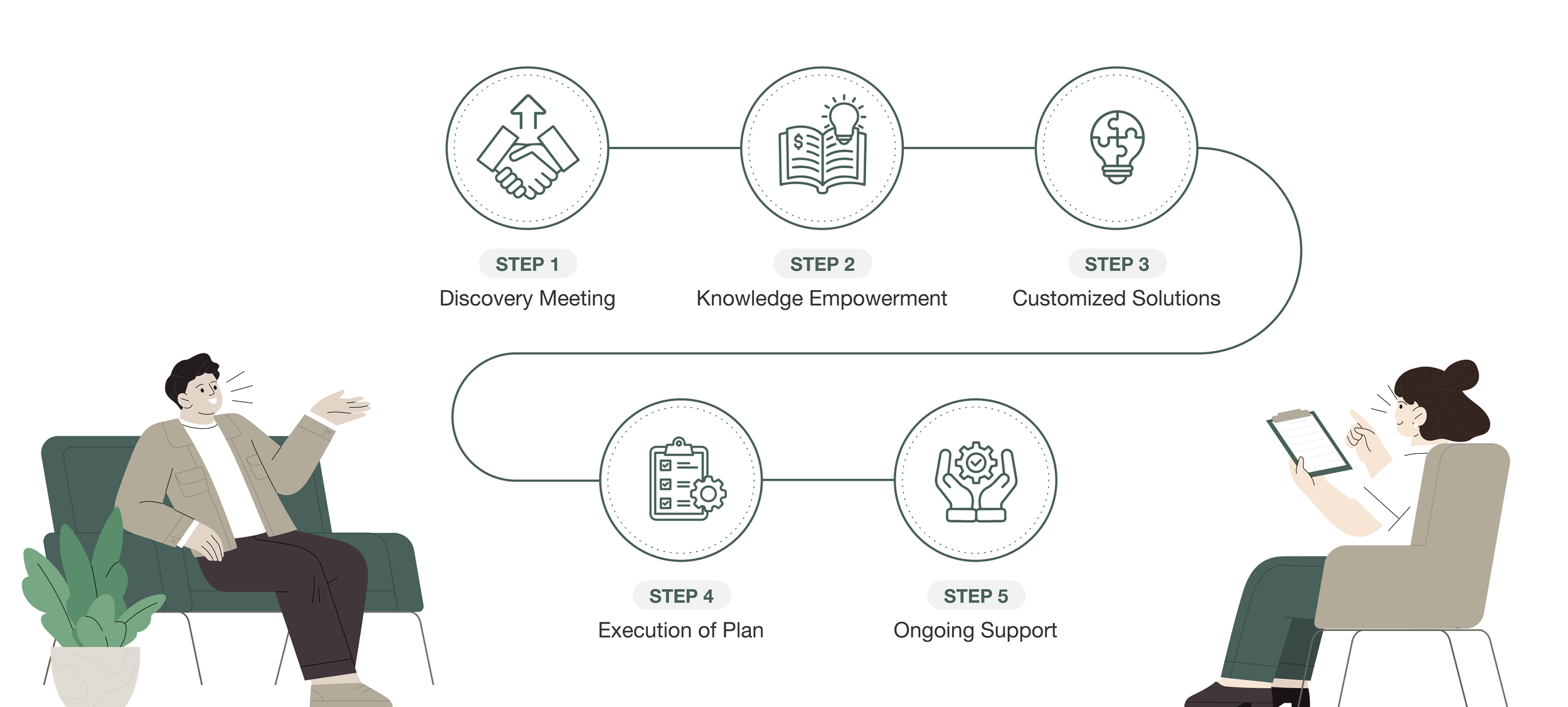

Our Financial planning Process

STEP1. Discovery Meeting

Our first meeting is all about laying a strong foundation for our partnership. We use a simplified financial survey to pinpoint your key financial objectives and priorities. This process helps us establish where you stand currently, so we can set the groundwork for your financial plan. The survey is conducted in writing and includes the following content:

Financial Survey Content (Example)

Personal financial habits

Financial goals

Concerns about financial management

Experience with financial management tools

Areas of interest in financial management

STEP 2. Knowledge Empowerment

Once we have a thorough understanding of your financial situation, we focus on empowering you with knowledge. We break down the pros and cons of various financial products, simplify complex financial regulations, and equip you with the tools to make informed decisions. This phase is critical in helping you make the best financial choices on your own.

- Basic Financial Concepts -

1. CRA (Canada Revenue Agency)

The government agency responsible for managing and collecting taxes in Canada.

2. Rule of 72

A rule of thumb to estimate the number of years required for an investment to double with compound interest.

3. Dollar Cost Averaging (DCA)

An investment strategy where you regularly invest a fixed amount, helping to reduce the impact of market volatility.

4. Financial Pyramid

A model that categorizes investments into layers based on risk, starting with low-risk assets at the bottom and higher-risk investments at the top.

5. How Money Works

A set of concepts related to earning, spending, saving, and investing money effectively.

6. Leveraging

A strategy of using borrowed funds to potentially increase returns.

7. The Big Picture

An overall financial plan and strategy designed to achieve your long-term financial goals.

8. Water Bowl Model (Tax, Inflation, Returns, Time, Income)

A conceptual model that uses the analogy of a water bowl to explain how various factors like taxes, inflation, returns, time, and income interact in financial management.

STEP 3. Customized Solutions

After analyzing your financial details, we offer customized solutions and strategies that align with your objectives. Whether it's maximizing tax returns, enhancing investment returns, or planning for real estate savings and retirement, we provide expert advice to help you reach your goals effectively.

STEP 4. Execution of Plan

With a clear strategy in place, we move forward with implementation. We work alongside a team of professionals, such as accountants, lawyers, and bankers, to ensure that every aspect of your financial plan is executed seamlessly.

STEP 5. Ongoing Support

In financial planning, our commitment to you truly begins when your plan is set in motion. We provide ongoing support, guiding you through both successes and challenges, and ensuring your financial decisions regarding investments, taxes, insurance, and other matters are well-informed. We maintain regular communication to ensure your financial plan evolves as your circumstances change.

Financial planning is an ongoing process that adapts to your evolving needs and goals. From our initial discovery meeting to the continuous support we provide, every step is designed to ensure your financial plan is comprehensive, personalized, and effective. By partnering with us, you gain not only a tailored strategy but also the knowledge and guidance needed to make informed decisions and confidently navigate your financial future. Let us help you take the first step toward financial success.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee