[VOL.004] The Secret to Wealth-Building: Unlocking the Power of Time

In today's economic landscape, Canadians face mounting financial strain - from persistent inflation and soaring housing costs to the challenge of living paycheck to paycheck. While these pressures can make planning for the future seem daunting, they actually underscore the critical importance of strategic financial planning. The key lies not in finding a universal solution, but in developing a personalized approach that addresses your unique circumstances and goals.

Financial independence begins with mastering fundamental concepts. This knowledge serves as your foundation, enabling you to evaluate your current position, identify opportunities for growth, and craft strategies that align with both personal and professional financial objectives. Without these essential principles, you might miss crucial opportunities for building long-term wealth and financial security.

By understanding and applying these core concepts, you can create a robust financial plan that not only provides stability but also adapts to life's changes, giving you the confidence to navigate any financial challenge.

The Power of Starting Early: Time is Your Greatest Asset

The most compelling principle in wealth-building is the impact of time. The earlier you start saving and investing, the greater your money's growth over time. This growth is driven by compound interest, where your investment’s interest generates its own earnings.

Consider this: investing $2,000 annually from ages 22 to 27 can yield significantly more retirement savings than investing the same amount from ages 28 to 62. This dramatic difference stems from compound growth - your money grows not just from your initial investment, but from years of accumulated returns. The power of this effect will become clearer in the graph that follows.

The impact of early investing becomes even more crucial when considering today's retirement needs. BMO's 13th Annual Retirement Study revealed that Canadians now estimate they need $1.7 million to retire, a 20% increase from the $1.4 million reported in 2020. This rising benchmark emphasizes the urgency of early action. While delaying savings limits your growth potential, starting early - even with modest contributions - leverages time to build substantial wealth.

Understanding Rate of Return: Your Growth Catalyst

Your investment's rate of return fundamentally impacts your wealth-building journey. Higher returns can boost growth, but they often come with increased risk. The goal is to strike a balance that aligns with your objectives.

The Rule of 72 offers a practical way to understand investment growth. By simply dividing 72 by your expected annual return rate, you get a rough estimate of how many years it will take for your investment to double in value. For example, if you're expecting a 6% annual return, this calculation shows that your investment would likely double in about 12 years (72 ÷ 6). The graph below demonstrates the Rule of 72 in action, showing how investments grow at different annual return rates—3%, 6%, and 12%.

In financial planning, understanding the Rule of 72 is essential for several reasons:

Setting Realistic Goals: Knowing the timeline for investment growth allows you to set achievable financial goals, like saving for retirement, a home, or other major milestones.

Encouraging Early Investment: The longer your money is invested, the more compounding can enhance your future wealth. Delaying investments limits the long-term growth of your savings.

Evaluating Investment Options: Applying the Rule of 72 helps evaluate different opportunities and make informed choices based on risk tolerance and goals.

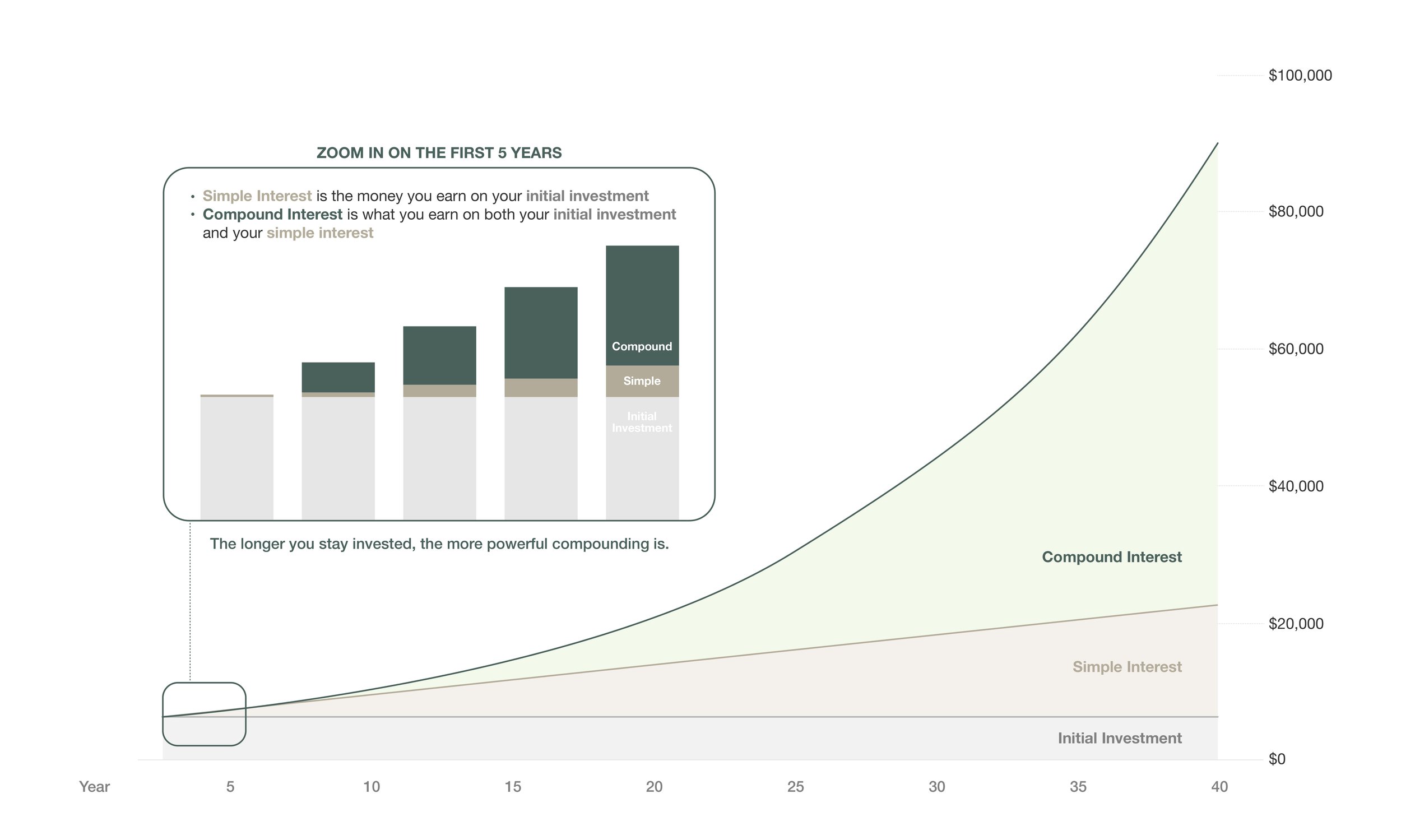

The Rule of 72 becomes even more powerful with compound interest, as interest earned compounds over time, resulting in exponential rather than linear growth. To illustrate this dramatic difference, consider a single investment of $6,000: With simple interest at 7% annually, your money grows steadily but modestly. However, with compound interest at the same rate, that $6,000 could grow to approximately $90,000 over 40 years – a striking demonstration of earning money on the money you earn. Looking at the graph below, you can see this remarkable contrast between simple and compound interest, where the compound interest line curves upward dramatically while simple interest follows a straight path.

Your Financial Success Starts Now

A financial plan tailored to your unique needs does more than provide stability; it enables you to seize opportunities and face future uncertainties with confidence. The principles covered today – early investing, compound interest, and the Rule of 72 – serve as stepping stones to financial freedom. While the current economic climate may present challenges, these fundamentals are powerful tools for building lasting wealth. Remember, it’s not about how much you start with, but how soon you begin.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee