[VOL.003] Independent vs Bank Financial Planner

Discover the key differences between Independent Financial Planners and Bank Financial Planners to make an informed decision about your financial future.

Securing your financial future is a critical decision, and selecting the right financial planner is crucial to that process.

When considering your options, it’s essential to differentiate between Independent Financial Planners and Bank Financial Planners. While both professionals aim to understand your financial objectives and provide tailored services, they differ significantly in their scope of work and approach.

Let’s explore these key similarities and differences, so you can choose the financial professional that best aligns with your needs.

Independent Financial Planner vs Bank Financial Planner

Commonalities

Supporting Financial Goals: Both types of planners help clients set and achieve their financial goals.

Offering Financial Services: They provide a range of services, including financial planning, tax planning, investment advice, risk & insurance management, and retirement planning.

Conducting Client Consultations: They analyze clients' financial situations, goals, and risk tolerance to deliver tailored financial advice.

Complying with Regulations: Both are regulated by financial authorities in their respective regions and must adhere to industry standards and legal requirements.

Maintaining Expertise and Qualifications: Both professionals possess relevant education and professional qualifications in finance, economics, and financial planning.

Key Differences

1. Scope of Services:

Bank Financial Planner: Primarily offers financial products and services tied to their bank, such as deposit accounts, credit cards, loans, and investment products.

Independent Financial Planner: Provides a comprehensive suite of financial services from various providers, including investment management, tax planning, retirement and estate planning, and risk management.

2. Client Relationship:

Bank Financial Planner: Engages in short-term, product-specific interactions.

Independent Financial Planner: Fosters long-term relationships, providing ongoing support and personalized advice.

3. Product Range:

Bank Financial Planner: Limited to a specific set of products offered by their bank.

Independent Financial Planner: Delivers curated financial plans, selecting from a broad array of resources to best meet client needs.

4. Expertise and Approach:

Bank Financial Planner: Specializes in the bank’s products, often promoting these specific solutions.

Independent Financial Planner: Provides a comprehensive approach, leveraging broad financial knowledge to offer unbiased, independent advice across a wide range of financial needs.

5. Customization:

Bank Financial Planner: Aligns solutions with the bank’s policies.

Independent Financial Planner: Delivers tailored solutions designed to closely match your unique financial situation, offering objective advice as they are not tied to any specific institution or product.

Choosing the right financial planner is key to achieving your financial goals. While Bank Financial Planners may offer familiarity with their institution’s products, Independent Financial Planners provide a broader, unbiased approach tailored to your unique needs.

At DIEM Financial Planning, we pride ourselves on delivering independent, personalized financial advice that puts your interests first. Whether you're planning for retirement, managing investments, or navigating complex financial decisions, our experienced team is here to guide you. Partner with us to build a financial future that truly reflects your aspirations!

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.002] Financial planning Process

Explore the main steps in the financial consultation process, from the initial meeting to ongoing support.

We’ll now explore the essential components of the financial planning process, giving you a clear picture of what to expect when working with a financial planner. From your first consultation to ongoing support, we'll guide you through the steps that ensure your financial plan is comprehensive, personalized, and adaptable to your evolving needs.

Whether you're new to financial planning or seeking to refine your existing strategy, this guide offers valuable insights to help you make informed decisions.

meetings designed for you

Our meetings are designed to deeply understand your specific financial circumstances, goals, and preferences. Here’s what we prioritize during these sessions.

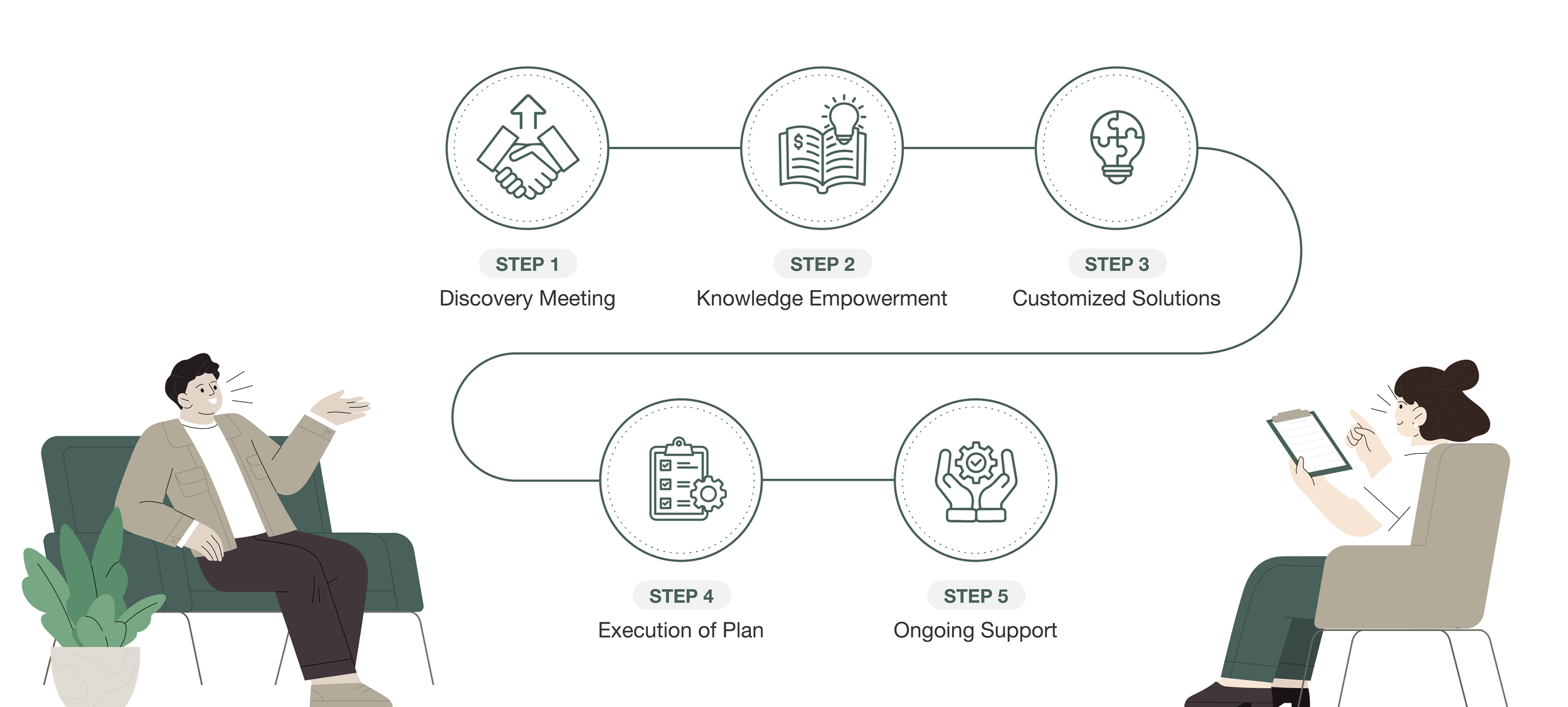

Our Financial planning Process

STEP1. Discovery Meeting

Our first meeting is all about laying a strong foundation for our partnership. We use a simplified financial survey to pinpoint your key financial objectives and priorities. This process helps us establish where you stand currently, so we can set the groundwork for your financial plan. The survey is conducted in writing and includes the following content:

Financial Survey Content (Example)

Personal financial habits

Financial goals

Concerns about financial management

Experience with financial management tools

Areas of interest in financial management

STEP 2. Knowledge Empowerment

Once we have a thorough understanding of your financial situation, we focus on empowering you with knowledge. We break down the pros and cons of various financial products, simplify complex financial regulations, and equip you with the tools to make informed decisions. This phase is critical in helping you make the best financial choices on your own.

- Basic Financial Concepts -

1. CRA (Canada Revenue Agency)

The government agency responsible for managing and collecting taxes in Canada.

2. Rule of 72

A rule of thumb to estimate the number of years required for an investment to double with compound interest.

3. Dollar Cost Averaging (DCA)

An investment strategy where you regularly invest a fixed amount, helping to reduce the impact of market volatility.

4. Financial Pyramid

A model that categorizes investments into layers based on risk, starting with low-risk assets at the bottom and higher-risk investments at the top.

5. How Money Works

A set of concepts related to earning, spending, saving, and investing money effectively.

6. Leveraging

A strategy of using borrowed funds to potentially increase returns.

7. The Big Picture

An overall financial plan and strategy designed to achieve your long-term financial goals.

8. Water Bowl Model (Tax, Inflation, Returns, Time, Income)

A conceptual model that uses the analogy of a water bowl to explain how various factors like taxes, inflation, returns, time, and income interact in financial management.

STEP 3. Customized Solutions

After analyzing your financial details, we offer customized solutions and strategies that align with your objectives. Whether it's maximizing tax returns, enhancing investment returns, or planning for real estate savings and retirement, we provide expert advice to help you reach your goals effectively.

STEP 4. Execution of Plan

With a clear strategy in place, we move forward with implementation. We work alongside a team of professionals, such as accountants, lawyers, and bankers, to ensure that every aspect of your financial plan is executed seamlessly.

STEP 5. Ongoing Support

In financial planning, our commitment to you truly begins when your plan is set in motion. We provide ongoing support, guiding you through both successes and challenges, and ensuring your financial decisions regarding investments, taxes, insurance, and other matters are well-informed. We maintain regular communication to ensure your financial plan evolves as your circumstances change.

Financial planning is an ongoing process that adapts to your evolving needs and goals. From our initial discovery meeting to the continuous support we provide, every step is designed to ensure your financial plan is comprehensive, personalized, and effective. By partnering with us, you gain not only a tailored strategy but also the knowledge and guidance needed to make informed decisions and confidently navigate your financial future. Let us help you take the first step toward financial success.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee

[VOL.001] Understanding Financial Planning

Learn the importance of financial planning in Canada and explore how we can guide you toward financial success.

Welcome to DIEM Financial Planning!

Our name, DIEM, reflects our commitment to making the most of each day by seizing opportunities and focusing on daily growth. We believe in taking proactive steps every day toward financial success.

We understand that life can be unpredictable. From navigating complex tax issues to managing unexpected financial challenges, our mission is to provide comprehensive financial planning that offers peace of mind and long-term security. Our goal is to craft a financial plan that not only addresses your current needs but also safeguards you against future uncertainties, allowing you to focus on what matters most.

Let’s explore how expert financial planning can be a game-changer in achieving your financial goals.

How We Help You with Financial Planning

Financial planning is more than just managing your money—it's about securing your future. We’re dedicated to guiding you through every aspect of your financial journey. This includes making informed decisions about banking, investment management, insurance, retirement planning, and tax optimization. Our approach is tailored to your unique goals and circumstances, ensuring that your financial plan reflects your distinct needs and aspirations.

Why Financial Planning is Essential

We understand the unique financial landscape of Canada and the challenges it presents:

Navigating Canada’s Complex Tax System: Our expertise helps you take full advantage of tax benefits while minimizing your tax burden, ensuring that your finances are optimized.

Building a Diverse Investment Portfolio: With a wide array of financial products available in Canada, we’ll help you create a customized investment strategy that balances risk and aligns with your financial goals.

Securing Your Retirement: Planning for retirement can be daunting, but with our guidance, you can be confident in your preparations. We’ll help you develop a plan that ensures you have the resources needed to enjoy your retirement years.

Managing Economic Uncertainty: In times of economic volatility, we provide strategies to protect your financial stability and manage potential risks.

Personalized Financial Plans: We understand that one size doesn’t fit all. That’s why we offer customized plans that reflect your unique financial goals and life circumstances.

Staying Current with Evolving Financial Regulations: As regulations change, we help you stay informed and adjust your plans to remain compliant and current.

Our Commitment to Your Financial Success

At DIEM Financial Planning, we believe in the power of collaboration. We work with a network of experts, including lawyers, accountants, and real estate professionals, to provide you with a comprehensive financial management experience. Our team approach ensures that you receive well-rounded advice tailored to your needs.

We’re here to answer any questions or concerns you may have about your finances. Whether you're seeking guidance on a specific issue or looking to build a robust financial plan, we’re committed to helping you achieve your financial goals. Stay tuned for more insights and stories designed to empower your financial future.

Thank you for considering DIEM Financial Planning as your partner in financial success. We look forward to working with you.

Looking for a Korean version of this post? Click Here

Content & Graphic Design by Chaasy Design / Content Collaboration with Chloe Lee